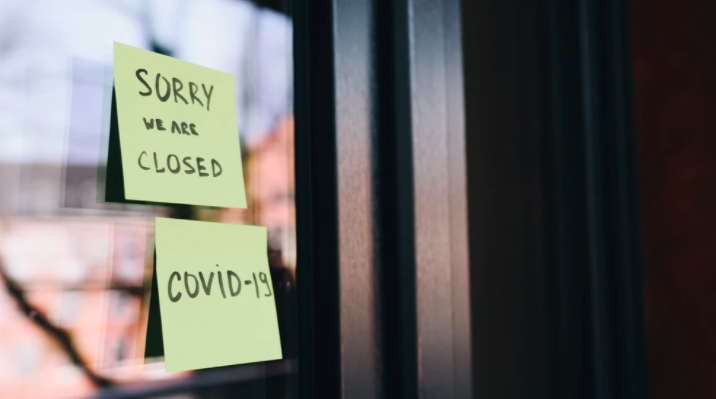

The South African tourism and hospitality sector has been heavily impacted by the COVID-19 pandemic. To rub salt in the wound, various insurance providers are not paying out Business Interruption claims. A petition has been formed to call on insurance providers to pay their claims. It garnered over 1,000 signatures in the first 24 hours.

The petition is calling on all South Africans, including the business sector, to support their cause by signing the petition and by re-evaluating their insurance providers.

Many businesses are suffering losses.

Many of these businesses are facing imminent closure, which will result in a broken tourism sector and the loss of thousands of jobs, which they say can be avoided if insurers honour their contractual obligations and pay out on these claims.

Restaurants, hotels, lodges, cafes and other tourism businesses took out Business Interruption insurance that includes cover for infectious and notifiable diseases. However, companies like Santam, HIC and Guardrisk (owned by Momentum), Hollard, Old Mutual, Thatch and Bryte are rejecting claims, saying that Government’s lockdown, and not the COVID-19 pandemic, is responsible for the deep losses experienced by these small and medium businesses.

This week, the Western Cape High Court compelled Guardrisk to honour the COVID-19 Business Interruption insurance claims of Cafe Chameleon, a restaurant in Cape Town.

The judge rejected Guardrisk’s argument that the losses suffered by the claimant was due to the lockdown, and not the COVID-19 pandemic.

‘All along, the Insurers have said that they need the courts to provide legal certainty that they are liable, before they honour their clients’ claims. We now have that certainty, but we don’t see any insurer stepping up. The true test of a company’s ethics and values is how they treat their most vulnerable customers at their time of need. Thus far, the actions of these goliaths don’t match their words, which are all centred on behaving responsibly and in line with deep ethical values. Actions speak louder than words, and their actions continue to be unethical,’ says Robert More, CEO of the MORE Family Collection, who started the petition.

‘The sector is bleeding jobs. By paying out our claims, the insurers can actually save jobs in our vulnerable sector, and by saving jobs, they have the power to actually save lives in our country right now. People are starving,’ says More.

‘South Africans have a long history of coming together in a time of crisis. We implore all our countrymen and women to join us in holding these insurance giants to account. This will not only save our tourism sector, which we all love and need, but also the many thousands of jobs it sustains.’

Business Interruption insurance exists to help companies survive an unanticipated event. There are generally two types of BI insurance: a basic policy which requires physical damage to the business premises in order to trigger a claim, and a Tourism / Hospitality policy that contains a specific extension that includes interruption by infectious or contagious notifiable disease. These companies all have the latter.

The petition can be found here.

Image credit: Unsplash