A pay-for-results approach to conservation aims to improve funding for black rhinos and other threatened species.

Thousands of wildebeest and zebra flattened the grass of the Masai Mara. Among them was a large boulder in silhouette against the fading light.

A long horn broke the rim of the dark shape and I realised it was moving. The black rhino trod slowly towards a copse of whistling-thorn acacia, then it stopped dead still. It did not eat. It became again, a boulder, permanent, resolute. I watched it for what seemed like an age, then the beast plodded away until it was devoured by the tall grass. That was 2013, the last time I saw a black rhino despite having visited a number of their rangelands since. But I will see more. I am optimistic.

The black-rhino population plummeted from an estimated 65,000 in 1970 to 2,300 in the 1990s. It has slowly risen to 5,500 today, but that small gain has been achieved through monumental effort and comparatively meagre donor funding.

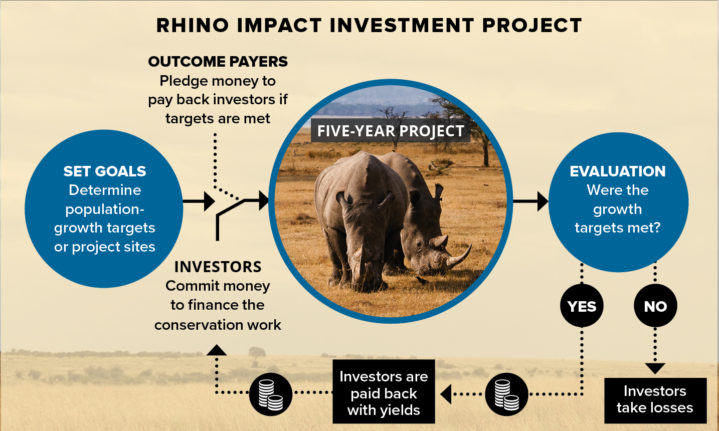

I came across a new financial model that could bridge the gap: The Rhino Impact Investment Project (RII). The thinking goes that by shifting conservation financing from traditional donor models to mainstream capital markets, funding could be used for much greater impact.

Currently in development, the concept is an initiative of United for Wildlife, a partner-ship between seven of the world’s leading wildlife charities, including the Zoological Society of London (ZSL) and The Royal Foundation of The Duke and Duchess of Cambridge.

‘There’s a $1bn-a-year funding shortfall for conservation and the traditional sources of conservation finance — philanthropists and donor agencies — are not going to be able to pick up the difference,’ says Giles Davies, senior partner and founder of Conservation Capital, the company appointed as financial manager of the RII.

It will be the first pay-for-results instrument for conservation, aimed at driving the recovery of the black rhino, as well as improving the management of black-rhino rangelands and, in the process, supporting the economies of local communities.

In partnership with five sites in South Africa and Kenya (Addo Elephant National Park; Great Fish River Nature Reserve; Tsavo West National Park, Ol Pejeta Conservancy and Lewa Borana Conservancy), which collectively manage 12 per cent of the world’s black-rhino population and critical ecosystems, the RII team are working with site managers to develop new black-rhino management strategies to achieve ambitious but achievable growth over five years.

How it works

Impact investment has been widely used to finance social projects in health, education and food security. Investors provide up-front finance for the services of professionals working on the projects, such as doctors, teachers and farmers, and the investors receive a return from the ‘outcome-payer’ (usually a government or philanthropic organisation) when target results have been achieved.

In the case of the rhino project, investors would pay upfront for certain strategies to be carried out by rangers, vets, project managers and others on the ground, and the outcome-payers would commit to reimbursing the investor’s capital plus a success-related bonus.

While traditional donor finance focuses on service delivery, impact investment focuses on outcomes. So, rather than counting the supplies used to aid rhino- population recovery, the focus shifts to counting the growth in the rhino population. This gives people on the ground more incentive to achieve results and the freedom to innovate, use proven strategies and adapt the finance to achieve the outcome, which is more difficult with traditional-donor finance.

‘Attracting novel funding sources to address global rhino issues will encourage a sector-wide evolution from box-ticking to delivering results’, says Chris Gordon, ZSL Kenya Country Manager and RII Project Pilot Site Manager.

This new approach may be the last chance that black rhinos have. Current donor funding won’t suffice. Perhaps saving a species from obliteration is not enough motivation, but financial profit is.

Field notes by Anton Crone

This article was first published in the April 2020 issue of Getaway magazine.

Get this issue →

All prices correct at publication, but are subject to change at each establishment’s discretion. Please check with them before booking or buying.